The SLN function in Excel is a powerful tool designed to calculate the straight-line depreciation of an asset for one period. Depreciation is the gradual reduction in the value of an asset over time due to wear and tear, age, or obsolescence. Straight-line depreciation is the simplest and most commonly used method, where the asset loses the same value each period.

Key Takeaways:

- The SLN function calculates straight-line depreciation, where an asset loses the same value each period.

- Depreciation reduces an asset’s value due to factors like wear, age, or obsolescence.

- SLN is easy to use and ideal for consistent, predictable financial planning.

- This method is widely accepted in accounting and financial reporting.

- SLN’s simplicity is its strength, but it may not be suitable for assets with varying depreciation patterns.

Table of Contents

Diving Into Depreciation: Understanding the Basics

What is Straight Line Depreciation?

Straight Line Depreciation is the simplest and most commonly employed method to calculate an asset’s loss of value over time. It assumes an asset will lose the same value each year over its useful life.

This approach is favored for its ease and consistency, allowing for predictable financial planning. In other words, it spreads out the initial cost of an asset, minus any salvage value, evenly across its useful lifespan.

The Importance of Accurate Depreciation in Financial Reporting

Accurate depreciation is pivotal in financial reporting for several key reasons. Firstly, it impacts the balance sheet by reducing the value of assets and increasing accumulated depreciation – this provides a more accurate picture of a company’s net worth.

Secondly, it affects the income statement since depreciation is a non-cash expense that reduces taxable income. It’s crucial for businesses to get this right for tax purposes and to reflect true profitability.

Additionally, investors scrutinize these numbers to assess a company’s asset management and future investment potential. Depreciation is not just a compliance issue but also a strategic financial tool.

Exploring Excel’s SLN Function

Breaking Down the SLN Function Syntax

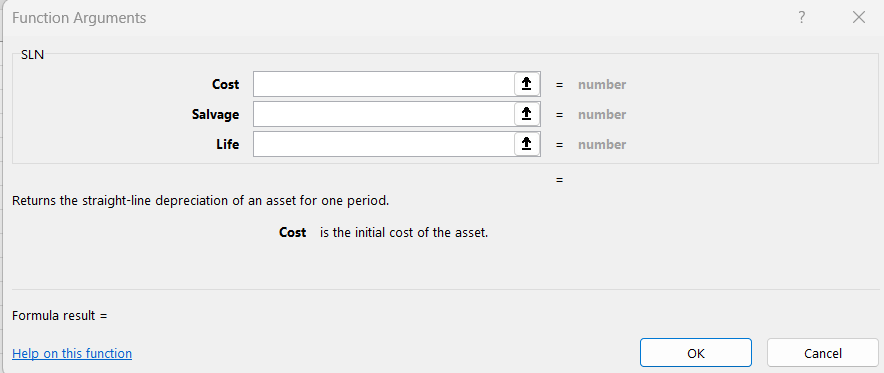

The syntax for the SLN function is concise yet powerful: SLN(cost, salvage, life). Understanding each segment is essential for harnessing the function’s full potential. Let’s take a closer look:

Cost: This is the initial investment or purchase price of the asset before any depreciation has taken place.Salvage: This represents the expected value of the asset at the end of its useful life. It’s also known as the residual or salvage value.Life: This denotes the asset’s useful lifespan, over which the cost will be evenly depreciated. It is important that this is consistently measured, typically in years.

These parameters must be defined with care. Consistency in units across these inputs is critical; otherwise, results can be misleading. Properly setting these parameters ensures that the SLN function delivers meaningful and accurate calculations.

Hands-On Examples: Using SLN in Real-World Scenarios

SLN Function Example: Depreciating Office Equipment

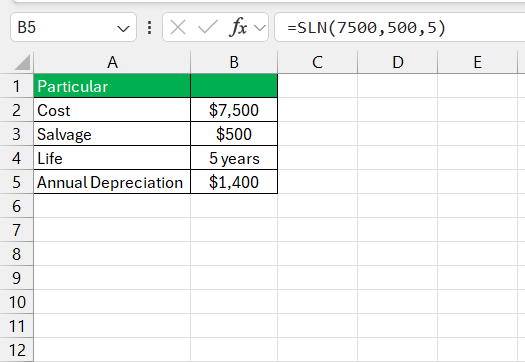

Imagine a company has invested $7,500 in new office computers with an expected useful life of five years and a salvage value of $500. Using the SLN function in Excel to calculate annual depreciation would look like this: SLN(7500, 500, 5).

The output reveals that the yearly depreciation expense for the computers is $1,400. This figure is derived from equally spreading the depreciable base ($7,000, which is the cost minus salvage value) over the useful life.

Applying the SLN function allows for a straightforward depiction of how assets diminish in value over time, providing clarity to the company’s financial framework. It transposes a large initial expenditure into manageable, annual fiscal measures, instrumental in comprehensive budget planning and cost management.

Advanced Utilization: SLN with Other Depreciation Methods

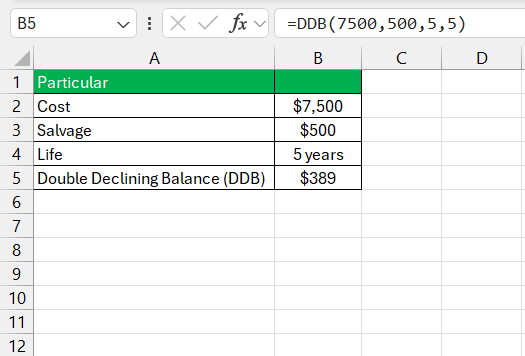

When the straight-line method isn’t the sole approach to depreciation that an enterprise wishes to explore, the SLN function can be utilized alongside alternative methods like Declining Balance (DB) or Double Declining Balance (DDB).

By comparing the results from the SLN function with those generated by other methods, a business can gain insights into how different depreciation strategies impact their financial statements over the life of an asset.

Tips and Tricks to use SLN function

Why Use the SLN Function?

- Simplicity: The SLN method is easy to understand and implement, making it ideal for small businesses and straightforward financial models.

- Consistency: It provides a consistent expense every period, which simplifies budgeting and forecasting.

- Standard Method: SLN is a standard method of depreciation accepted by many accounting practices, making it useful for compliance and financial reporting.

Limitations of the SLN Function

While the SLN function is convenient, it has its limitations:

- Ignores Time Value of Money: The SLN method does not consider the time value of money, meaning it doesn’t account for the fact that a dollar today is worth more than a dollar in the future.

- Not Suitable for All Assets: The SLN method may not be appropriate for assets that lose value quickly in the early years or have variable depreciation patterns.

- Simplistic Approach: For assets with complex depreciation patterns, other methods like Declining Balance or Units of Production may be more appropriate.

Troubleshooting Common SLN Function Errors

Typical Pitfalls When Applying the SLN Function

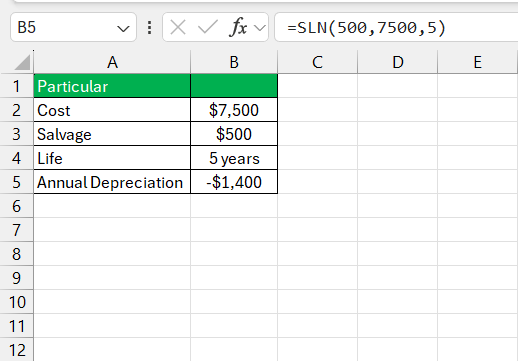

While the SLN function is straightforward, users might encounter typical pitfalls. One common error arises from incorrect input values, such as mixing up the cost and salvage figures, leading to inaccurate depreciation calculations.

Another issue is inconsistency in the units of measurement for the asset’s life; some might mistakenly input months instead of years, skewing results significantly.

Furthermore, overlooking the need to enter the correct salvage value or assuming it to be zero by default may result in overstated depreciation expenses. Similarly, users must be cautious about the asset’s useful life estimation, as overly optimistic or pessimistic figures can lead to financial misrepresentation.

It’s advisable to double-check the inputs for accuracy and maintain the unit consistency to prevent costly mistakes. After all, errors in depreciation calculations can have far-reaching implications for financial statements and tax reporting.

Tips to Ensure Smooth SLN Function Implementation

To ensure smooth implementation of the SLN function, consider these practical tips:

- Verify all input values for accuracy, ensuring that the cost, salvage value, and useful life are correctly entered and correspond to the same asset.

- Maintain consistent units across all parameters, no mixing of months with years or different currencies.

- Document assumptions regarding the salvage value and useful life to maintain transparency and ease future audits or reviews.

- Use named ranges or tables in Excel for better readability and manageability when referencing cells in the SLN function.

- Test the SLN function with known values to confirm that it operates as expected within your spreadsheet.

These steps will help circumvent potential obstacles and foster an environment where the SLN function is a reliable tool for financial calculations.

FAQ: Mastering the SLN Function

What does sln mean in Excel?

SLN stands for Straight-Line Depreciation in Excel. It’s a built-in function that calculates the depreciation of an asset for a specified period using the straight-line method, dividing the depreciable cost of the asset by the number of years of its useful life.

How to use the sln function in Excel?

To use the SLN function in Excel, input the formula =SLN(cost, salvage, life) into a cell, replacing ‘cost’ with the asset’s initial cost, ‘salvage’ with its salvage value at the end of its useful life, and ‘life’ with the asset’s useful life period. Excel will compute the annual depreciation expense.

How Does the SLN Function Affect a Company’s Balance Sheet?

The SLN function affects a company’s balance sheet by systematically reducing the book value of an asset through depreciation. Each year, the depreciation expense calculated by the SLN function is deducted from the asset’s value, decreasing the company’s total assets and equity, yet it does not impact cash flow since depreciation is a non-cash expense.

Can I Use the SLN Function for Depreciating Assets Over Irregular Timeframes?

No, the SLN function is not designed for irregular timeframes; it calculates depreciation over consistent, regular periods. For irregular depreciation schedules, other functions like VDB may be more appropriate.

Where Can Beginners Access More Resources on Excel’s Depreciation Functions?

Beginners can find more resources on Excel’s depreciation functions through Microsoft’s online documentation, Excel-centric educational websites, and video tutorials on platforms like YouTube. Many online courses also cover Excel’s financial functions, including depreciation.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.