Daily compound interest is a key concept in finance that determines how your money grows when interest is added more than once a year. Daily compounding means interest is calculated and added to the balance every day, which can make a noticeable difference over time. Excel makes it easy to perform these calculations using built-in formulas.

Key Takeaways

- Daily compounding calculates interest every day using the updated balance.

- The formula is

Principal * (1 + Rate/Compounds) ^ (Compounds * Years)where Compounds = 365 for daily compounding. - Formatting percentages and currency correctly is important for clear results.

- Excel can calculate daily compounding for a single value or for entire tables.

- VBA macros and Power Query can automate compound interest calculations for large datasets.

Table of Contents

Understanding Daily Compound Interest

Daily compounding means that interest is calculated and added to the balance 365 times a year. Each day, the interest is based on the current balance, which already includes interest from previous days. Over time, this leads to faster growth compared to annual or monthly compounding.

The Importance of Compounding Frequency

Compounding frequency refers to the number of times interest is applied to the principal balance in a given time period. The frequency can significantly affect the total amount of interest accrued on an investment or loan. Common compounding frequencies include annually, semi-annually, quarterly, monthly, and daily—each with a unique impact on growth.

For instance, daily compounding means interest is calculated and added to the principal balance 365 times a year, leading to a higher accumulated interest compared to annual compounding. The more frequently interest is compounded, the more quickly your balance grows. Understanding compounding frequency is crucial when comparing financial products, as it directly influences the effective annual rate (EAR).

In Excel, adjusting the compounding frequency is straightforward. By modifying the value of ( n ) in your formula, you can easily compare different compounding scenarios and make informed financial decisions.

Step-by-Step: Calculate Daily Compound Interest in Excel

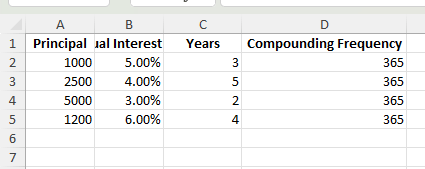

Enter your data: Include columns for Principal, Annual Interest Rate, Years, and Compounding Frequency. For daily compounding, use 365 as the frequency.

Principal Annual Rate Years Compounds 1000 5% 3 365 2500 4% 5 365 5000 3% 2 365 1200 6% 4 365

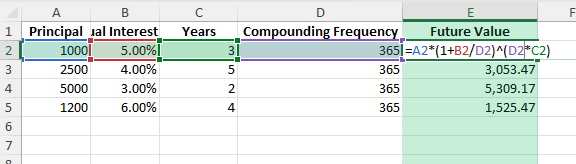

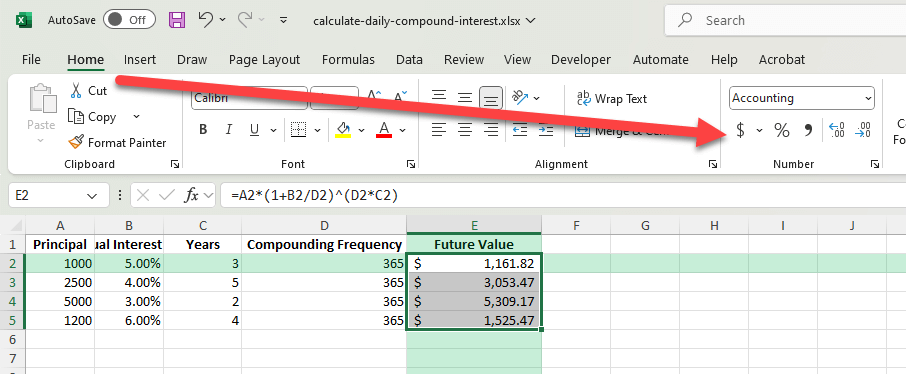

Apply the formula: In a new column, use:

=A2*(1+B2/D2)^(D2*C2)

Where:

- A2 is the principal

- B2 is the annual rate

- D2 is the compounding frequency (365)

- C2 is the number of years

Format the results: Format the principal and final amount as currency, and the interest rate as a percentage.

Copy down: Fill the formula for all rows to calculate each result.

Common Mistakes and How to Avoid Them

Incorrect frequency: For daily compounding, the compounding frequency should be 365, not 12 or 1.

Forgetting parentheses: The formula needs parentheses around (1 + Rate/Compounds) to ensure the correct order of calculation.

Rate formatting: If you enter rates as whole numbers (like 5 instead of 0.05), divide by 100 in the formula.

Wrong exponent: The power should be Compounds * Years to account for all compounding periods.

Bonus Tips and Advanced Scenarios

Daily Interest Breakdown: Create an extra column to calculate interest earned each day using:

=PreviousBalance * (Rate/Compounds)

Then update the balance by adding the daily interest.

Power Query Automation: Load your dataset into Power Query, create a custom column with the compound interest formula, and load the results back into Excel.

VBA Macro: Automate the process for multiple rows:

Sub CalculateDailyCompoundInterest()

Dim rng As Range

For Each rng In Selection.Rows

Dim principal As Double

Dim rate As Double

Dim years As Double

Dim compFreq As Double

principal = rng.Cells(1, 1).Value

rate = rng.Cells(1, 2).Value

years = rng.Cells(1, 3).Value

compFreq = rng.Cells(1, 4).Value

rng.Cells(1, 5).Value = principal * (1 + rate / compFreq) ^ (compFreq * years)

Next rng

End Sub

Advanced Techniques for Savvy Users

Handling Variable Interest Rates

Handling variable interest rates in Excel requires a keen understanding of how interest rates can change over time and influence your calculations. Unlike fixed rates, variable rates fluctuate, often in response to market conditions. To accurately compute compound interest with variable rates, you’ll need to adjust your calculations for each period with a new rate.

Begin by setting up a spreadsheet where each row represents a different period in time. Enter the corresponding interest rate for each period in adjacent columns. Use Excel functions like FV to dynamically calculate future values that reflect changing rates. Here’s an example of how you might structure your formula:

- Column A: Time Period

- Column B: Variable Interest Rate

- Column C: Principal Amount

- Column D: Future Value Calculation

To create a seamless calculation, utilize formulas like =C2*(1+B2/365)^365 and drag them across relevant cells. This will automatically apply the respective rate to that period.

This method ensures that your forecasts or investment evaluations take into account the real-world scenario of fluctuating interest rates, providing a more accurate financial picture.

Incorporating Regular Deposits into Calculations

Incorporating regular deposits into your compound interest calculations adds another layer of complexity and potential growth. When you consistently add funds to your principal, it significantly increases the total amount accumulated over time. Use Excel to efficiently handle these regular deposits, ensuring your financial forecasts are both accurate and comprehensive.

Start by setting up columns to detail your deposit schedule, interest rate, compounding frequency, and time period. Let’s break it down:

- Initial Principal: Enter the starting amount.

- Regular Deposit Amount: Specify how much you’ll deposit regularly.

- Interest Rate: Offer your annual rate here.

- Compounding Frequency: Define the number of times your interest compounds annually.

- Periods: Lay out the number of total periods, such as months or quarters.

Excel’s FV function integrates these elements smoothly. The formula to use, taking monthly deposits as an example, would be:

=FV(interest_rate/compounding_periods, total_periods, -monthly_deposit, -initial_principal)

This formula will reflect the compounded growth of both your initial principal and the effects of regular deposits, giving you a complete picture of your savings or investment trajectory.

Frequently Asked Questions

What is the formula for daily compound interest? Principal * (1 + Rate/Compounds) ^ (Compounds * Years), where Compounds = 365.

Can Excel calculate interest for partial years? Yes, you can use decimal values for years, such as 2.5 for two and a half years.

Do I need to change the formula for leap years? Typically, 365 is used, but you can use 366 for leap years if needed.

How do I handle different compounding frequencies? Replace 365 with the number of compounding periods per year, such as 12 for monthly.

Can I separate interest earned from the principal? Yes, subtract the principal from the final amount to get the total interest earned.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.