Days Inventory Outstanding (DIO) is a key financial metric revealing the efficiency of a company’s inventory management by measuring how quickly inventory turns into sales. Understanding DIO is crucial for improving cash flow management and optimizing inventory practices. It serves as a financial compass, guiding businesses towards better operational health and offering investors a clear indicator of a company’s revenue-generating potential.

Key Takeaways

- DIO offers crucial insights into inventory turnover speed, affecting revenue and business efficiency. A lower DIO means faster sales conversion, crucial for healthy cash flow.

- Calculating DIO requires dividing average inventory by COGS and multiplying by 365. Understanding these components is key for precise DIO analysis.

- High DIO can indicate overstocking or inefficiencies, harming cash flow. In contrast, low DIO shows efficient turnover and strong product demand.

- Optimizing DIO involves improving forecasting, streamlining inventory management, enhancing sales tactics, and monitoring DIO trends for financial health.

- Adopting technology, like inventory software and automated data collection, boosts DIO by improving accuracy, visibility, and inventory control.

Download the spreadsheet and follow along with the blog on How to Calculate Days Inventory Outstanding in Excel – Download excel workbookDays-Inventory-Outstanding.xlsx

Table of Contents

Introduction to Days Inventory Outstanding (DIO)

Unlocking the Essence of DIO

Days Inventory Outstanding, or DIO, is a crucial performance metric that offers you a window into how efficiently your company is managing its inventory. This figure shows how swiftly your business turns its stock into sales. A solid understanding of DIO can serve as a financial compass, guiding you toward better cash flow management and inventory practices.

Why DIO Matters in Business Operations

For anyone managing a business, DIO isn’t just another acronym to remember; it’s a pivotal indicator of your operational health. The speed at which you sell your inventory directly impacts your revenue and top-line growth. A long DIO can indicate sluggish cash flow and underused operational capacity.

For investors, DIO is a litmus test revealing the strength of a business and its potential to generate revenue. In the competitive marketplace, the efficiency of converting inventory into sales through effective management and pricing strategies, often reflected in the DIO, can mark the difference between thriving and merely surviving.

The Core Elements of DIO Calculation

Decoding the DIO Formula

The formula for calculating Days Inventory Outstanding might feel daunting at first, but once you break it down, it’s quite straightforward. Essentially, DIO evaluates how many days your inventory sits before turning into sales. The standard formula is:

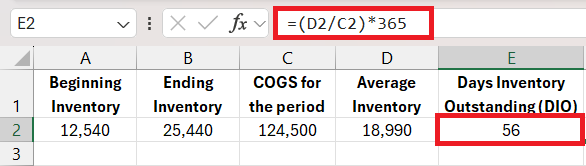

Days Inventory Outstanding (DIO) = (Average Inventory ÷ Cost of Goods Sold) × 365 Days

Let’s unpack this a bit. You take your average inventory — that’s the midpoint between your inventory levels at the start and end of a given period — and divide it by the cost of goods sold (COGS), which is what you’ve spent on producing or purchasing the goods you’ve sold. Multiply that by 365 days, and you have your DIO, indicating the average number of days the inventory is held.

Alternatively, you can flip the perspective and divide 365 days by your inventory turnover ratio, another important inventory metric. Here’s what that looks like:

Days Inventory Outstanding (DIO) = 365 Days ÷ Inventory Turnover

Regardless of the method used, the goal is to understand how efficient your business is at converting inventory into sales, which is crucial for maintaining healthy cash flows and minimizing holding costs.

A Closer Look at Average Inventory and Cost of Goods Sold

Understanding the components of the DIO formula is key to getting accurate results. The two main elements are Average Inventory and Cost of Goods Sold (COGS).

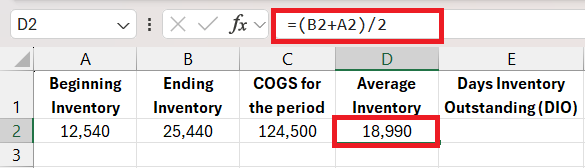

Average Inventory is the mean value of the inventory over a specific period, typically calculated by adding the inventory values at the beginning and end of the period, and then dividing by two. This smooths out any spikes or drops in inventory levels, offering a more accurate picture of the inventory held over time.

Cost of Goods Sold (COGS) reflects the direct expenses related to the production or purchase of your goods sold within a period. These costs include materials and labor but exclude indirect expenses like marketing and transport. They can be found on your income statement.

When combined in the DIO formula, these figures help you comprehend how long your goods remain as inventory before they become sales — a critical metric for assessing the liquidity of your assets and your supply chain’s effectiveness.

Practical Application: Calculating DIO in Excel

Step-by-Step Guide for Computing DIO

When calculating DIO in Excel, follow these steps to ensure an accurate and efficient process:

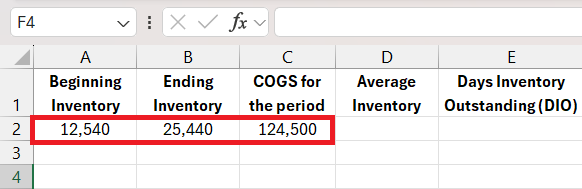

STEP 1: Prepare Your Data: Ensure you have your inventory values at the beginning and end of the period, as well as your total COGS for that period.

STEP 2: Calculate Average Inventory: In a cell, enter the formula to calculate average inventory (=(Beginning Inventory + Ending Inventory)/2).

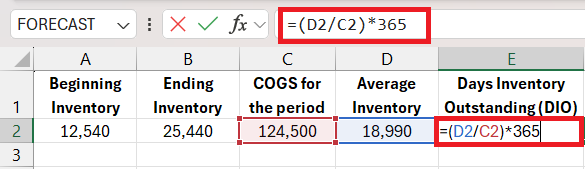

STEP 3: Apply the DIO Formula: In a new cell, use the formula to compute DIO: =(Average Inventory/COGS)*365. Make sure to reference the cells where you’ve calculated the average inventory and entered the COGS.

STEP 4: Press Enter Once the formula is in place, press Enter and Excel will compute the DIO for you.

By following these steps, you can utilize Excel to not only compute DIO but also maintain a historical record, which is invaluable for trend analysis and inventory optimization.

Interpreting Your DIO Results

What Does a High DIO Indicate?

A high Days Inventory Outstanding (DIO) signals that a company’s inventory is not being converted into sales at an efficient pace. This could mean a variety of things:

- Overstocking Issues: Your company might be holding onto more inventory than the market demands, pointing to possible overestimation of sales forecasts.

- Sales Challenges: It may highlight issues in the sales processes or market dynamics, with goods not moving as quickly as expected.

- Inventory Management: The high DIO may suggest inefficiencies in production or ordering processes, possibly indicating that the company needs to revisit their inventory strategy.

- Cash Flow Implications: Capital is tied up in unsold goods for longer periods, which can strain cash flow and limit financial agility.

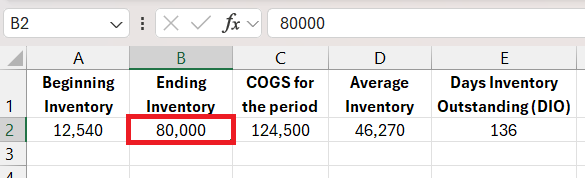

In this example, a high DIO of 136 days is shown in cell E2, which highlights one or many of the above things can cause this.

Businesses need to analyze their high DIO in context, considering industry norms and seasonal fluctuations, to ensure informed decisions are made.

The Implications of a Low DIO Score

A low Days Inventory Outstanding (DIO) generally reflects positively on your company’s operations, indicating a rapid conversion of inventory into sales. This quick turnover can lead to several beneficial outcomes:

- Enhanced Cash Flow: With inventory selling quickly, cash is more readily available for other operations or investments.

- Reduced Risk of Obsolescence: A low DIO means a lower chance of inventory becoming outdated or unsellable, protecting your investment.

- Indication of Demand: It often suggests strong demand for your products and an effective sales strategy.

- Operational Efficiency: Your inventory management system may be well-optimized, contributing to overall operational efficiency.

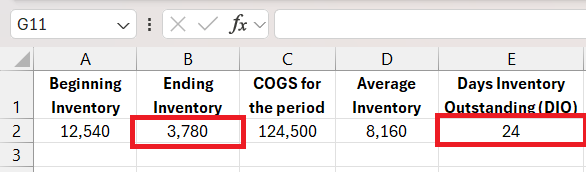

In the above example, the DIO is only 24 days, which reflects positively on the company but it is like maintaining a careful balance; a DIO that’s too low could signal insufficient stock, risking your ability to meet demand spikes or supply chain disruptions.

Strategies for Optimal Inventory Management

Techniques to Improve Your DIO

To improve your Days Inventory Outstanding (DIO) and enhance inventory efficiency, consider these techniques:

- Refine Forecasting Accuracy: Match supply more closely with projected demand to avoid excess inventory.

- Streamline Inventory Management: Regularly review and adjust inventory levels to reflect sales patterns and trends.

- Improve Supplier Relations: Develop strategic partnerships with suppliers for more flexible inventory terms and quicker restocking.

- Enhance Sales Strategies: Implement promotions or discount pricing to move inventory more quickly.

- Monitor Metrics Closely: Keep a keen eye on DIO trends over time to anticipate and preempt potential issues.

By applying these strategies, you stand a better chance of optimizing inventory turnover and improving your company’s financial health.

Leveraging Technology for Enhanced Inventory Control

Embracing technology is a game-changer for superior inventory control and DIO optimization. Here’s how you can leverage the power of modern solutions:

- Implement Inventory Management Software: These systems provide real-time tracking and analytics to inform purchase and sales decisions.

- Automate Data Collection: Automated systems reduce human error and provide timely, accurate data for inventory tracking.

- Integrate Systems: Connect inventory software with other business systems such as CRM and accounting for a unified operational view.

- Utilize Cloud-Based Platforms: Cloud solutions enable access to inventory data from anywhere, fostering more agile decision-making.

- Adopt Smart Ordering Systems: Systems embedded with AI can predict demand fluctuations and automate reordering processes.

By incorporating these technologies, businesses can improve DIO figures through enhanced visibility, accuracy, and predictive power in inventory management.

DIO and Its Relationship with Other Metrics

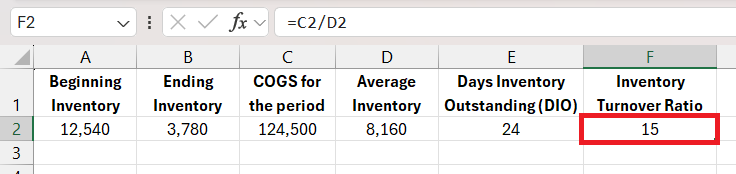

Comparing DIO with Inventory Turnover Ratio

Comparing DIO with the inventory turnover ratio helps you gain a multidimensional view of your inventory efficiency. While both are key performance indicators, they offer different perspectives:

- DIO measures how long inventory remains unsold in days.

- Inventory Turnover Ratio indicates how many times inventory is sold and replaced in a given period.

In terms of a relationship, usually, a lower DIO is associated with higher inventory turnover, suggesting a quicker movement of stock. Conversely, a higher DIO typically corresponds with lower inventory turnover, implying slower sales.

Understanding this relationship gives you a better grasp of how effectively your inventory is being managed and can lead to enhanced strategic decision-making for your business operations.

Understanding the Impact of DIO on Cash Flow

DIO directly affects your cash flow: the rate at which cash enters and leaves your business. A high DIO means cash is tied up in inventory for longer, potentially leading to a cash crunch. In contrast, a lower DIO suggests inventory is sold quickly, thus converting it back into cash.

Efficient cash flow management ensures that you have enough liquidity for day-to-day operations, unexpected costs, and growth opportunities. By reducing DIO, businesses can enhance cash availability, contributing to a more stable and flexible financial environment.

FAQs on Days Inventory Outstanding

What Constitutes a Good DIO Rate?

A “good” DIO rate varies widely across industries due to differences in inventory movement. For instance, supermarkets aim for a low DIO due to perishable goods, while furniture stores can afford higher DIO numbers. It’s crucial to benchmark against industry averages and strive for a DIO that’s competitive within your sector to ensure you’re keeping pace with or outperforming similar businesses.

To determine what’s good for your business, consider historical patterns, seasonal fluctuations, and industry-specific trends. Continuously monitor and compare your DIO to these benchmarks to gauge your inventory management’s effectiveness.

How Often Should Businesses Calculate Their DIO?

Businesses should calculate their DIO regularly, typically on a monthly, quarterly, or annual basis. This frequency enables them to track performance trends, respond to market changes, and make informed inventory decisions. More frequent calculations can be beneficial for businesses with fast-moving inventory or those seeking more responsive management strategies.

What is the formula for days inventory outstanding?

The formula for Days Inventory Outstanding (DIO) is: =(Average Inventory/COGS)*365 where Average inventory is: Average inventory = (Beginning inventory + Ending inventory)/2

What is inventory turnover ratio?

The inventory turnover ratio gauges how many times a company’s inventory is sold and replaced over a certain period. It’s calculated by dividing the cost of goods sold (COGS) by the average inventory during that time. A higher ratio signifies efficient inventory management and robust sales.

How can you create a low DIO ratio?

Creating a low DIO ratio involves improving inventory turnover by reducing lead times, aligning purchasing with demand forecasts, accelerating sales through marketing and promotions, and regularly reviewing inventory levels to avoid overstocking. Efficient processes and smart decision-making are key.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.