Embark on your journey to financial mastery with our Financial Statement Cheat Sheet in Microsoft Excel – a beacon to illuminate the complex web of numbers and terms. Designed for discerning FP&A professionals, this cheat sheet is a pragmatic guide that simplifies income statements, balance sheets, and cash flow statements into clear, actionable insights. Step confidently into the financial narrative, armed with tools that translate data into engaging, boardroom-worthy stories.

Key Takeaways

- Simplifies the complexity of financial statements into user-friendly language, akin to a morning coffee order.

- Includes essential overviews of Income Statement, Balance Sheet, and Cash Flow Statement basics.

- Demystifies financial ratios, making them approachable tools for assessing financial health.

- Contains a glossary of handy Excel formulas, aiding quick comprehension and application.

Table of Contents

Introduction to Financial Statement Analysis with Excel

The Importance of Mastering Financial Statements

Welcome to the Essential Realm of Financial Reporting

Hello there, financial enthusiast! Ever felt like financial statements are akin to intricate puzzles? Well, worry not. You’re about to unlock the secrets to analyzing and understanding these financial narratives. And the best part? You’ll be harnessing the power of Excel to bring clarity to the complex world of numbers.

How Excel Simplifies Financial Analysis

Turning Complicated to Simple with a Click

Excel is like a superhero for your spreadsheet worries. Imagine needing to sift through tables of financial data. Daunting, right? But Excel comes to your rescue, transforming data chaos into organized information with just a few formulas and functions. It makes financial analysis not only manageable but almost enjoyable!

By providing versatile tools for sorting, calculating, and presenting data, Excel helps you crunch numbers faster than you can say “spreadsheet.” Whether you’re budgeting, forecasting, or evaluating financial performance, Excel ensures you spend less time wrestling with numbers and more time drawing meaningful insights.

Unveiling the Cheat Sheet for Financial Statements

Balance Sheet Breakdown: Assets, Liabilities, and Equity

Navigating the Triad of Financial Stability

Dive into the core of a company’s financial health with the balance sheet, an essential snapshot of financial standing. Here’s how Excel helps you dissect the balance sheet’s three crucial components:

Assets: Think of assets as the fuel that powers the company. They’re everything the company owns, from cash to buildings. With Excel, organizing and calculating total assets becomes a breeze with simple summation functions.

Liabilities: These are the obligations or debts the company owes. Tracking liabilities is a cakewalk with Excel’s categorization features, ensuring you understand what’s borrowed against what’s owned.

Equity: Often referred to as shareholder’s equity, it’s the value remaining after liabilities are settled. Excel shines in calculating equity by crisply detailing retained earnings and stockholders’ investments with its powerful formula arsenal.

Employ Excel to present a clear, accurate view of a company’s financial status, providing investors and decision-makers with the insights needed to gauge stability and growth potential.

Income Statement Insights: Revenue, Expenses, and Profits

The Story Behind the Numbers

Uncovering the true narrative of a company’s operational success requires a deep dive into the income statement. Excel aids in portraying this story vividly by providing the tools to analyze revenue streams, operational costs, and the resulting profit or loss.

Revenue: This top-line number represents the income generated from normal business operations. Excel helps you not only sum up these figures but also break them down into categories or regions for a nuanced understanding, using functions like SUMIF().

Expenses: Costs incurred to generate revenue, like salaries, rent, and marketing, are crucial for understanding spending patterns. Excel’s pivot tables allow for dynamic grouping and summarization of these expenses, giving a clear picture of where funds are allocated.

Profits: Ultimately, the bottom line reflects the company’s profitability. Excel’s formulas, such as SUBTOTAL(), calculate this pivotal figure, letting you quickly assess financial success.

By employing Excel’s robust functionalities, you can efficiently reveal the financial saga unfolded by an income statement—the dynamics of cash generation and expenditure, painting the true hues of corporate profitability.

Key Excel Functions for Financial Reports

Mastering Formulas: SUMIF(), VLOOKUP(), and More

Empowering Financial Precision with Excel Formulas

Below are the essential formulas that transform raw data into priceless insights:

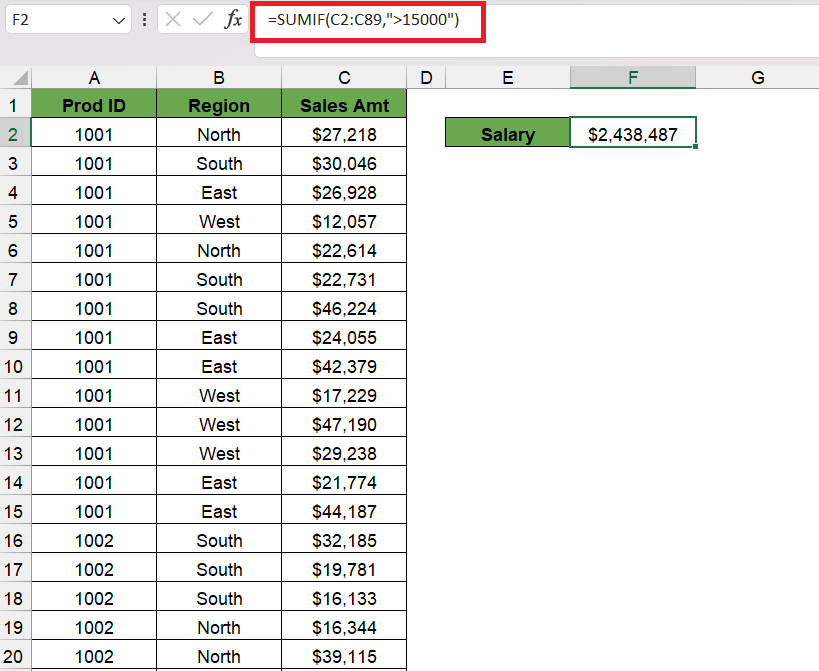

SUMIF(): Add up numbers selectively, based on specific criteria. Say goodbye to manual calculation errors and hello to efficiency, for tasks like totaling revenues from a particular product line or expenses within a certain category.

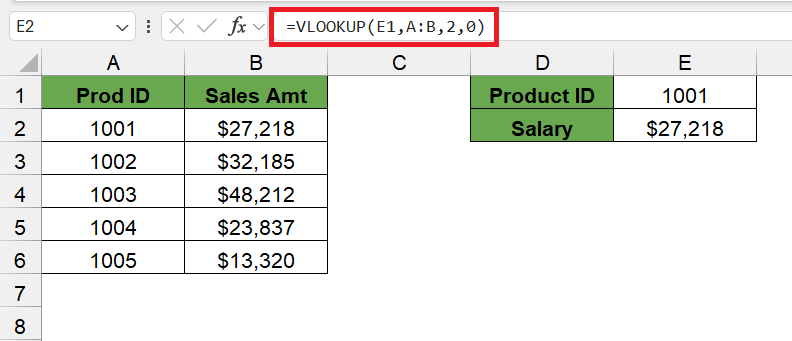

VLOOKUP(): The classic Excel lookup tool, VLOOKUP(), is perfect for matching financial data elements across different tables – like fetching the price of a stock from a table by its ticker symbol.

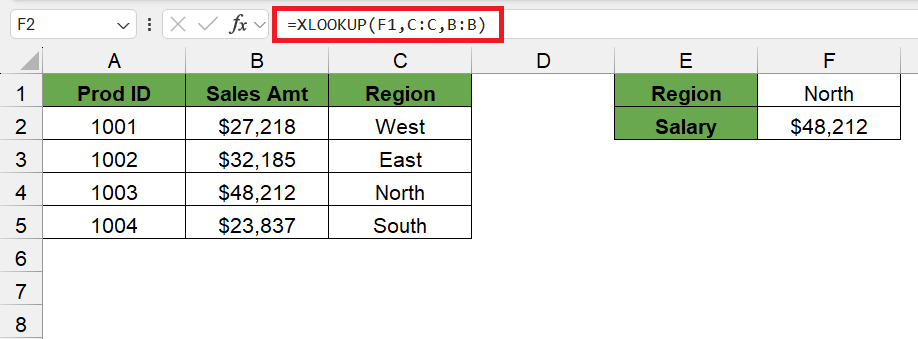

XLOOKUP(): This is the newer, more powerful cousin of VLOOKUP() that simplifies and broadens search capabilities. Now you can find anything in any direction with ease.

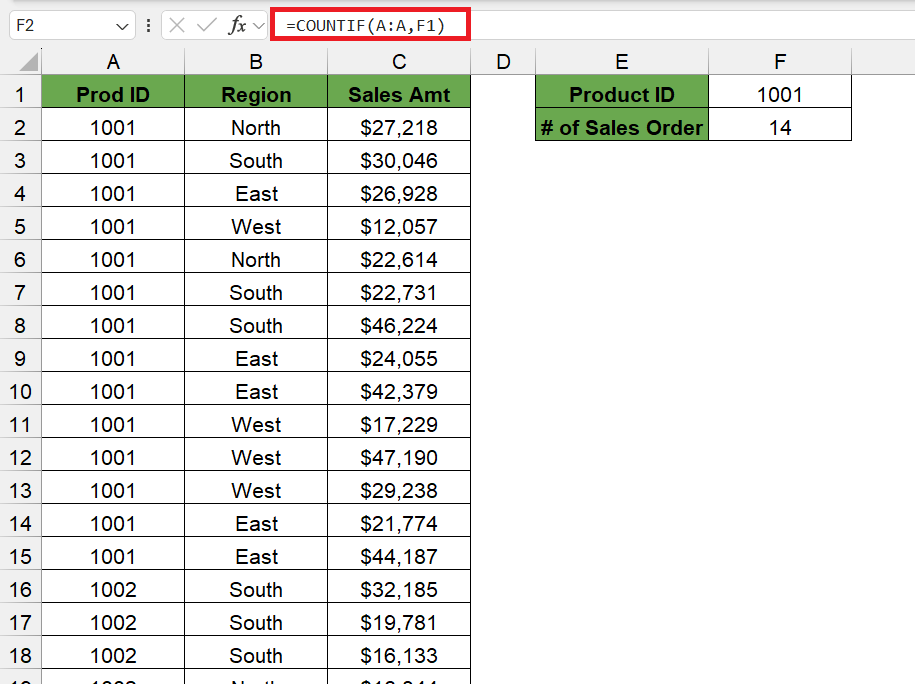

COUNTIFS(): Count cells matching multiple criteria, essential for quantifying entries, like how many times a certain expense exceeds a threshold.

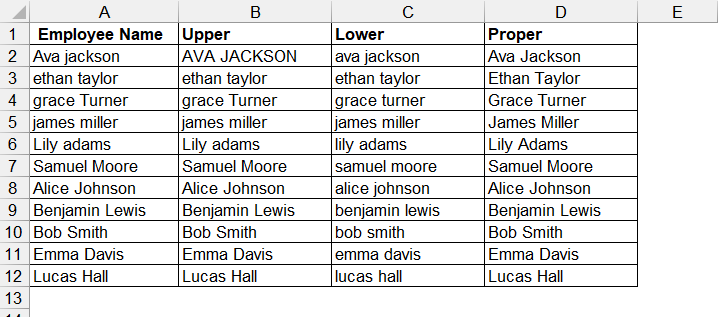

UPPER(), LOWER(), and PROPER(): Not strictly financial, but these text functions help tidy up your data for consistent, professional reports.

Embrace these formulas like your financial toolkit. They’ll ensure your reports are accurate and insightful, laying a foundation for stellar financial analysis.

Time-Saving Shortcuts for Financial Reporting in Excel

Speeding Through Spreadsheets with Fingertip Control

In the world of finance, time is as valuable as the data you analyze. That’s where Excel shortcuts become your time-shielding sword. Familiarize yourself with these keystroke wonders for speedier financial reporting:

Ctrl+S: Save your progress religiously without breaking your analysis flow.

Ctrl+Arrows: Zip through data ranges and hop to the edges of your data universe in a blink.

Alt+=: Instantly sum up the numbers above without typing the whole formula.

Ctrl+Shift+L: Apply filters to data headers, crafting a customized view of your financial landscape in no time.

F2: Edit a cell’s contents on the fly, making quick tweaks a walk in the park.

By incorporating these shortcuts into daily use, you’ll zip through financial reports, cutting down on manual labor and freeing up time for the more strategic aspects of your role.

Analyzing Financial Health with Excel Tools

Ratio Analysis Techniques: Liquidity, Solvency, and Profitability Metrics

Decoding Financial Health Through Key Ratios

Unlock the story your financial statements are eager to tell through ratio analysis in Excel. By quantifying relationships between figures on the balance sheet and income statement, these ratios offer a peek into operational effectiveness.

Liquidity Ratios: Can the company meet its short-term obligations? Tools like the Current Ratio (Current Assets/Current Liabilities) and Quick Ratio ((Current Assets - Inventory)/Current Liabilities) calculated in Excel provide that answer, showing how well-equipped a business is in covering immediate and short-term debts.

Solvency Ratios: Assess long-term stability with ratios like the Debt-to-Equity (Total Debt/Total Equity) and Interest Coverage Ratio (Earnings Before Interest and Taxes/Interest Expense). With Excel, these formulas help illuminate a company’s leverage and how comfortably it can handle long-term debts.

Profitability Metrics: These ratios, including Return on Equity (Net Income/Shareholder's Equity) and Gross Margin Ratio ((Revenue - Cost of Goods Sold)/Revenue), measure how effectively a company uses its resources to generate profits, a crucial gauge of overall health.

By mastering these Excel-calculated ratios, you establish a stronghold on financial assessment, helping paint a clear picture of the company’s viability and attractiveness to investors.

Trend Analysis and Forecasting with Excel Graphs and Charts

Predicting the Financial Future with Excel’s Visual Tools

Tap into Excel’s charting prowess to reveal the stories hidden within numbers. Here’s how you can use trend analysis and forecasting:

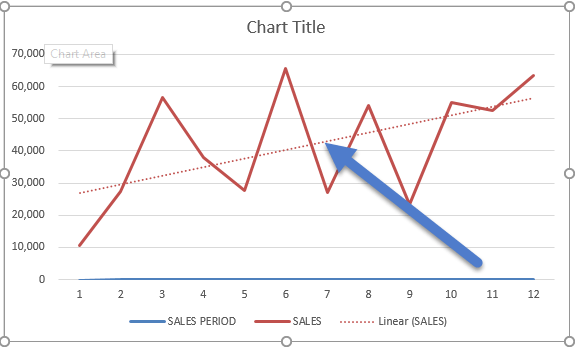

Line Charts: Perfect for visualizing data over time, line charts can display sales trends or expense trajectories, highlighting seasonal patterns or long-term growth.

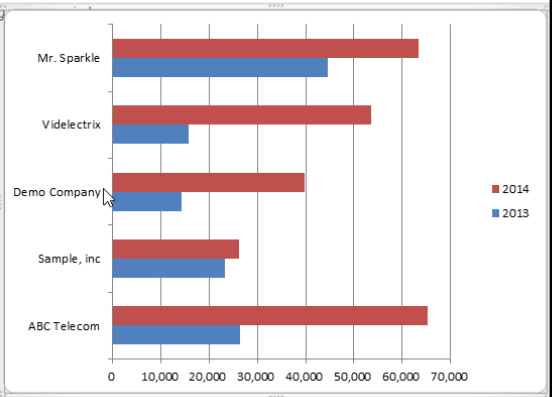

Bar Charts: When you need to compare different sets of financial data, bar charts help you quickly see differences across categories, such as revenue generated by different products.

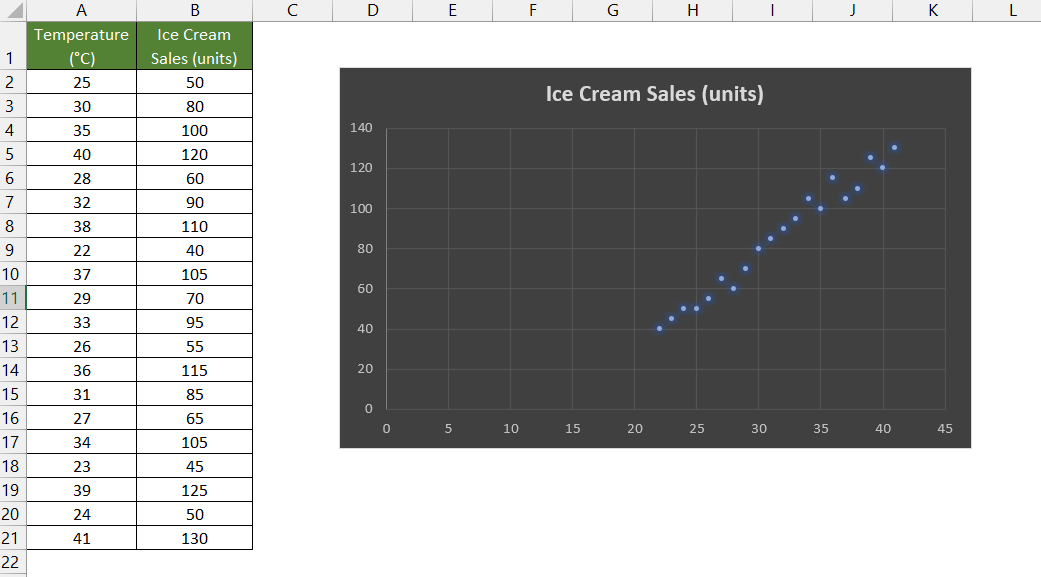

Scatter Plots: For more complex trend analysis, scatter plots can illustrate the relationship between two variables, potentially revealing correlations or anomalies in financial data.

Embrace these dynamic Excel features to transform columns of data into a compelling visual narrative, guiding smart, informed business decisions.

Advanced Excel Tips for Financial Gurus

Dynamic Tables and Conditional Formatting for Real-Time Data Assessment

Elevate Your Data Game with Interactive Overviews

Breathe life into your financial data with Excel’s dynamic tables and conditional formatting – powerful features that enable real-time, interactive data assessment.

Pivot Tables: Pivot Tables are Excel’s analytical powerhouses, turning extensive data sets into manageable summaries. They dynamically sort, count, total, or average data stored elsewhere in the spreadsheet, allowing for immediate updates as data changes.

Conditional Formatting: Go beyond static tables by adding visual cues to your data. With conditional formatting, Excel helps you automatically highlight trends and patterns, such as flagging underperforming financial metrics or accentuating growth areas.

These features make it effortless to interact with and draw conclusions from your financial data, turning mundane tables into dashboards of discovery.

Macros and Automation to Enhance Financial Modelling Efficiency

Harnessing the Power of Automation in Excel

Step into the realm of advanced Excel where macros and automation act as your digital financiers, streamlining your financial modeling endeavors.

Macros: Imagine repeating tedious tasks with a simple shortcut. That’s the magic of Macros in Excel. Record a sequence once, whether it’s formatting a report or inputting data, and replicate the action with the click of a button.

Automation: Excel’s automation capabilities extend beyond macros with features like Data Validation and Advanced Filters—tools that automate data entry rules and allow for sophisticated sorting without manual intervention.

Leverage these functionalities to fast-track your financial model’s construction, ensuring you spend more time analyzing outcomes rather than building frameworks.

Common Mistakes to Avoid in Financial Excel Reports

Preventing Errors with Absolute and Relative References

Cementing Accuracy in Spreadsheets

Navigating Excel’s absolute and relative references is pivotal in safeguarding your financial models against miscalculations. Keep these pointers in mind:

- Relative references are your go-to when replicating formulas across rows or columns, as they adjust based on the formula’s new location.

- Absolute references come to the rescue when you require certain constants, like a fixed interest rate, to remain unchanged no matter where you apply the formula.

Mix and match these references for precision, and ensure that your financial models stand unwavering amidst the waves of data entry and formula replication.

FAQs on Excel-Based Financial Statements

Which Excel formulas are most important for analyzing financial statements?

The most important Excel formulas for analyzing financial statements include SUMIF() for conditional summing, VLOOKUP() or XLOOKUP() for cross-referencing data, PV() and FV() for present and future value calculations, and RATE() for interest rate determinations. Additionally, financial ratio formulas for liquidity, solvency, and profitability are vital.

How can I use pivot tables to summarize financial data?

Pivot tables in Excel empower you to summarize and dissect financial data by categories and subcategories effortlessly. You can quickly group data, such as sales by product or expenses by department, and pivot tables will calculate and display sums, averages, or other statistical insights, all in a clear and interactive format.

What are some best practices for maintaining error-free financial models in Excel?

To maintain error-free financial models in Excel, it’s essential to:

- Implement consistent formula checks and audits.

- Validate all data entries with data validation tools.

- Use absolute references where necessary to prevent cell reference errors.

- Document all assumptions and sources for transparency.

- Structure your spreadsheet for easy navigation and comprehension.

- Regularly back up and version control your models to avoid data loss.

What Excel formulas are used in finance?

In finance, Excel formulas are crucial for data analysis, forecasting, and reporting. Key financial formulas include:

- PMT(): To calculate loan payments over time.

- NPV(): For net present value of cash flows.

- IRR(): To determine the internal rate of return for investments.

- XNPV() and XIRR(): For net present value and internal rate of return on specific dates.

- RATE(): To find the interest rate of an annuity.

These are among the many formulas that financial professionals rely on to evaluate investment opportunities and assess financial health.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.